One wrong turn on any social media platform and I’m sure you can find a myriad of Work-From-Home scams everywhere. I partially blame the aggressive inflation that’s squeezing every penny out of everyone’s pocket this year, which makes people easier to fall prey into those fraudulent promises. It’s definitely a challenging time that slowly takes its toll.

As middle-class America is fast shrinking, every dollar today counts more than the same one tomorrow. And for that reason, I’m inclined to remind us all of this safe side hustle to earn money from home: it is completely legal, requires a small capital, risk-free and 99.99% zero loss if executed with care and patience. Perhaps the game is there, it just needs the player. Hopefully this will help someone take in a few extra cash for a rainy day.

It’s called churning and it’s lucrative, but it’s nothing new.

While it’s mostly been under the radar for the majority, churning is a very popular method on many financial forums. There are many websites dedicated to this strategy such as Doctor of Credit.com, Bank Rewards.io.

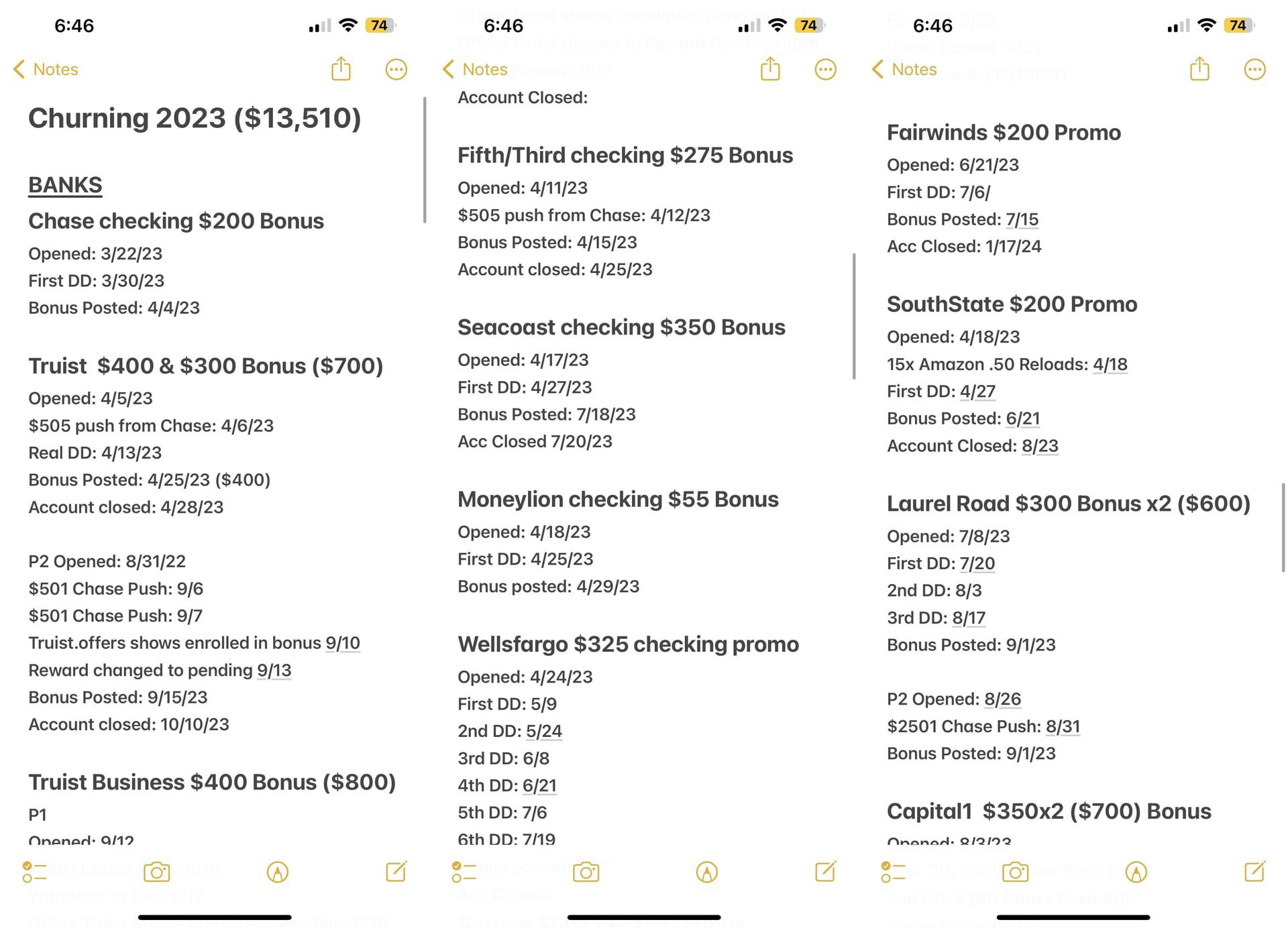

In the photos below, you can see the earning from churning has totaled up to $13,000 for this individual.

That may not sound like a lot, but as a supplemental earning that comes out roughly $1000 extra per month –I’m sure it will make its impact on someone’s financial health.

So basically, it’s a bonus deemed from a bank or a credit card institution.

Most banks aim to reach a quota to please their board of investors at the quarterly earnings report. Thus, banks give out incentivized bonus every now and then, between $200 to $800 on average to encourage people to join for their financial services. More client = more cash = better balance sheet + more funding to their investment strategy = happy quarterly earnings report = higher stock price.

Some business banks can reward up to $5000 bonus to the account holder but that is not something easy to attain if you do not have a large fund. On the other hand, regular checking or saving account has less required qualifying events for you to reap the bonus; and that’s what you might want to get started on first. Here’s a quick outline of the process:

1. Open an account with the bank/credit union using their reward code or URL.

Opening a bank account often does not affect your credit score since it’s a non-collateral self-funding service. The bank however may run a soft pull to make sure you are not here to launder money or have committed some financial crimes in the past.

Nevertheless, some credit union may do a hard pull which will leave an impact. So make sure you read the fine print carefully. I have included a few banks with bonuses at the end of this post for your choosing.

2. Qualifying events for the bonus.

The bank often requires a min balance ($5, $20, $100) and a of couple direct deposits up to a certain amount of dollars within a time frame in order to release the bonus. This is the part where people say, “I can’t do that because I can’t keep asking my employer to change direct deposite information!”. And you don’t have to. Direct deposit is a form of ACH transaction.

The bank often requires a min balance ($5, $20, $100) and a of couple direct deposits up to a certain amount of dollars within a time frame in order to release the bonus. This is the part where people say, “I can’t do that because I can’t keep asking my employer to change direct deposite information!”. And you don’t have to. Direct deposit is a form of ACH transaction.

ACH payment can be initiated via any Brokerage (Fidelity, Robinhood, Webull, Cashapp etc..) or a business bank.

That means you will only need to have one of those options and fund it with an initial amount to work with. You are not losing your money; it just moves from one place to another to earn you a decent ROI at the end of the day (Return of Investment).

Here’s basically how your cash may travel:

Your current bank » Business bank/Brokage » AHC Transfer » New bank with bonus » Back to original bank or pay for something.

In my opinion, churning is one of the safest methods to make your money works for you besides parking it all in a Fidelity SPAXX or HYSA. Here is a fun fact: there are over 4,470 FDIC-insured commercial banks in the US. Say you could only claim an average of $200 bonus from just half of them (2,235), that is $447,000 more in your pocket.

3. Keep track and account closure.

Once the bonus has been sent, some banks may require you to stay with them for several more months and have a small balance in the account. There should be no penalty to close a bank account but there might be penalty if you do so during a certain grace period. Read the fine print carefully to avoid having your bonus forfeited or fees applied.

4. Example: CapitalOne is giving $250 for new account holder.

The catch is having at least two $500+ direct deposits to your account within 75 days, no minimum balance required. You can initiate an ACH transfer of $505 to this new account, send $500 back to the first bank and repeat the same step again a few weeks later, then your account becomes qualified for the $250 bonus. Leave the account open for a few months for your bonus to come in. While you wait, you can look for other bonuses to earn from another financial institute.

I know many folks who put in the effort and grind for the first few months, then get a very happy payday a few months later. It’s often enough to fund a vacation or pay off other debts. It is a win-win for all parties: the bank gets to meet their quota and take advantage of your cash briefly for their own investment strategy, and you get a piece of the pie. On the long run, if you start to like a particular bank or credit union more than the other, you can stay banking with them for the better.

The downside of the churning strategy is perhaps you need to have spare cash to make the process work.

Although that money isn’t going anywhere, it might not be possible for a cash-strapped household to have the luxury of moving that amount around so much. In this case, you will have to start at an even smaller step of earning money from home, which I’ll talk about next time: how to earn some money from legitimate online betting websites.

For now, happy churning! If you have any questions, drop us a comment below!

Banks and Brokerages for ACH Transfer (To make ACH Direct Deposits)

Banks and Credit Cards with Bonuses

- M&T (Bank Bonus $400)

- Truist (Bank Bonus $400)

- Chase (Bank Bonus $300)

- Wells Fargo (Bank Bonus $325)

- SOFI (Bank Bonus $325)

- Clearview (Bank Bonus $200)

- Elgin State Bank (Bank Bonus $300)

- Columbia Bank (Bank Bonus $300)

- Axos Bank (Bank Bonus $300)

- CitiBank (Bank Bonus $300)

- CapitalOne (Bank Bonus $250)

- PNC Bank (Bank Bonus $400)

- Bank of America (Bank Bonus $200)

- First Tech Federal Credit Union (Bank Bonus $300)

- PSECU (Bank Bonus $300)

- TD (Bank Bonus $200)

- Citizens (Bank Bonus $300)

- Satander (Bank Bonus $400)

- Discover (Credit Card Bonus $100)

- Chase Sapphire (Travel Credit Card Bonus $600)