As a follow-on to Your 401k and You: Basic Information, I would like to summarize some of the main things you need to know about Traditional and Roth Individual Retirement Accounts (IRAs). If you see something that isn’t correct or have suggestions on other things to add, please let me know in the comments or by private message.

ELI5: How does an IRA work?

In plain English, an IRA is an account you put money into that receives favorable tax treatment. Each year you can elect to contribute money to your IRA using “out of pocket” money, as opposed to your 401k contributions which must be funded through payroll deductions. The annual contribution limit is $5,500 in 2013 and 2014. Do not go over this limit or penalties will be applied (and no, you can’t get around it – your IRA provider reports your contributions to the IRS as well as you do). In most cases, you must open your own IRA – the “individual” in “IRA” truly means individual!

In plain English, an IRA is an account you put money into that receives favorable tax treatment. Each year you can elect to contribute money to your IRA using “out of pocket” money, as opposed to your 401k contributions which must be funded through payroll deductions. The annual contribution limit is $5,500 in 2013 and 2014. Do not go over this limit or penalties will be applied (and no, you can’t get around it – your IRA provider reports your contributions to the IRS as well as you do). In most cases, you must open your own IRA – the “individual” in “IRA” truly means individual!

IRA plans come in several flavors, but the two main ones are:

- Traditional IRAs, which reduce your taxable income if you are under a certain income limit. Since you contribute to an IRA with money that has been taxed already, you claim a deduction at the end of the year if you qualify. After you get your refund for your traditional IRA contribution this money becomes “tax-deferred” – you will pay income tax on your contributions and your earnings at your marginal tax rate when you take distributions from your traditional IRA in the future.

- If you contribute to a Roth IRA, your contributions have already been taxed at your current marginal income tax rate. In exchange, earnings may be distributed tax free if the distribution meets certain age and eligibility requirements.

Which one do you choose? It depends on a lot of factors, but the big ones are:

- Income – Qualifying high earners are usually better off contributing to a traditional IRA, as this allows them to avoid paying their current high marginal tax rate. Conversely, those with lower incomes usually favor the Roth IRA, as they can pay a low marginal tax rate now in exchange for never being taxed on that money again.

- Your guess about your future income tax rates – Those that believe they will be in a lower income tax bracket when they retire usually favor the traditional IRA if they qualify for the deduction. Those that believe they will be in a higher income tax bracket when they retire usually favor the Roth IRA. Those that believe income tax rates will rise across the board in the future usually favor Roth IRAs.

Money you contribute to your IRA must then be invested in the funds your IRA provider offers you.

ELI5: How should I invest within my IRA?

Once you have contributed to your IRA, you are still left with the somewhat daunting decision of how to invest within your plan. One of the primary advantages of an IRA is that you get to choose who holds it – if you choose a provider like Vanguard, Fidelity, or Charles Schwab, you’ll have access to lots of inexpensive index funds or ETFs that you can invest in without paying a commission.

A good strategy that will serve anyone well is the 3-fund portfolio. In the 3-fund portfolio you aim to hold broadly diversified index funds in the three major asset classes: US stocks, International stocks, and Bonds. By investing in this manner you are instantly diversified across thousands of different securities, will never significantly underperform the market, and are mathematically certain to outperform most investors doing differently.

Note: If you have other retirement accounts, your asset allocation should be considered across all of your accounts. Doing so can make managing your retirement accounts go from dealing with this to dealing with this. See the Bogleheads’ Wiki page asset allocation in multiple accounts.

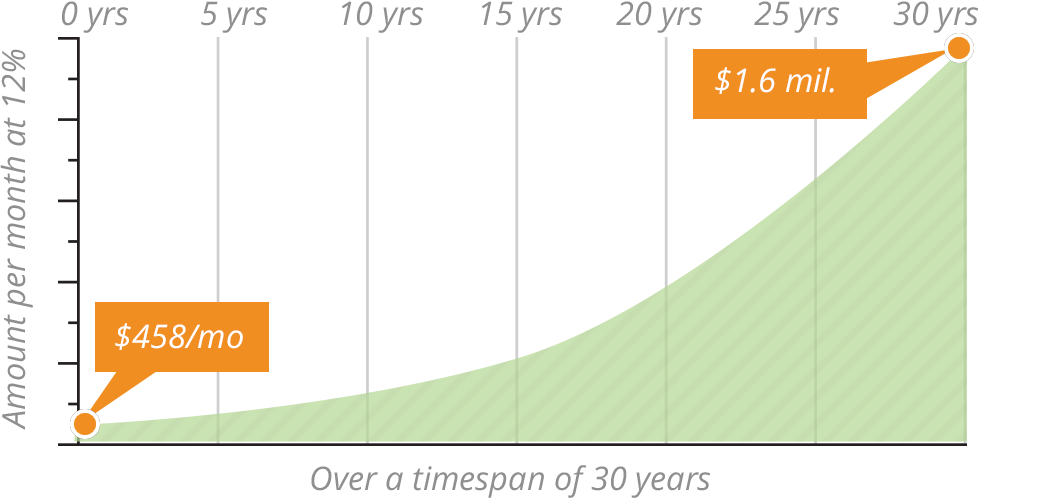

Identifying what asset class a fund belongs to can be challenging, but most IRA providers’ websites will identify which fund belongs to which asset class. Googling the fund name or looking up the ticker symbol on a website like Morningstar will usually make it obvious. Identifying which funds are index funds can be even more difficult, but in general index funds will have expense ratios that are much lower than the other available funds. The expense ratio is the annual fee you pay for the privilege of investing in the fund. A low expense ratio is the single best indicator of superior long-term performance. An expense ratio of 1.5% may not seem like a lot, but when compared with an index fund charging an expense ratio of 0.3%, that 1.2% difference compounded over 30 years will add up to tens of thousands of dollars in lost returns. Vanguard offers various tools to compare the costs of investing in high or low expense ratio funds (1, 2).

Unfortunately not all IRA providers are created equal, and some providers do not have a good selection of low-cost funds to invest in. If this is the case with you, don’t worry too much. Moving IRAs from one provider to another is usually just a matter of filling out a few forms and mailing them in. A month later or so your IRA will be with your new provider. See your chosen provider’s website for the exact process, but in general you’ll just need your tax/personal identification information as well as sign a consent form that allows the new provider to take your IRA and move it.

ELI5: Asset Allocation

Your asset allocation is how you divide your money amongst the various asset classes and the various funds you’ve elected to invest in. The literature on asset allocation is extensive – use Google if you want the nitty gritty details. Here are some basic rules of thumb:

- The core of your portfolio should be the three major asset classes – US stock index funds, International Stock index funds, and Bond index funds.

- A good starting point for determining your bond holding percentage is [your age]%.

- At least 20% of your stock holdings should be in an international stock index fund [Source].

- The younger you are, the more risk you can afford to take on in the form of higher allocations to stocks.

- Your asset allocation can and should change over time. A 25-year old’s investments will be very different than a 55-year old’s.

- Target date funds take the work out of asset allocation for you. Target date funds will automatically get more conservative as you age, reducing your exposure to major market movements as your ability to wait them out declines. If you are fully invested in a target date fund in your 401k it’s probably a good idea to go with a target date fund in your IRA as well.

Some other frequently asked questions

1. The contribution limit for an IRA is $5,500 – can I contribute $5,500 to both a Roth IRA and a traditional IRA?

No. The $5,500 contribution limit is a total limit to all IRAs you contribute to in a given tax year. As an example, someone with two IRAs could contribute $4000 to IRA A and $1500 to IRA B (or any combination that adds up to $5500). That said, there’s no limit on the number of IRAs you can have that I am aware of.

2. I do not report any earned income to the IRS because of the standard deduction/overseas earned income exclusion/whatever – can I still contribute to an IRA?

No. You are allowed to contribute the lesser of your earned income or $5500. If you do not report earned income, you are not eligible to contribute to an IRA.

3. I want to retire early. Should I contribute to my IRA and lock up my money until age 59.5?

From [arichi]: If you plan to retire before 59.5, but close to it – say, at 55 or so – you can use 72(t) distributions to access pre-tax money without penalty. If you do so even earlier, you can access it with a five-year delay via a Roth IRA conversion ladder, although you’ll still need the first five years’ expenses available via taxable accounts, Roth IRA contributions, and perhaps part-time work.

4. Should I pay off debt or contribute to my IRA?

IRA contributions rank behind emergency funds, employer-matched 401k contributions, and high-interest debt. You should only consider an IRA if you’ve taken care of these things first. Remember that paying down debt offers something that only scammers can claim otherwise – guaranteed, risk free return!

5. I’m a young person and want to invest aggressively – why invest in bonds at all?

Bonds provide a source of funds to purchase potentially higher-yielding investments when they can be had at discount prices during market downturns, reduce your portfolio’s volatility, and usually offer a steady return themselves. On the technical side, there are numerous studies that show that 100% (or more) stock investors are not compensated in proportion to the extra risk they take on by doing so. While stocks have outperformed bonds over the long run to date, “past performance is not indicative of future returns.” Finally, the psychological/emotional effects of a severe bear market really cannot be appreciated until they’re felt first hand. It is one thing to say you’re OK watching half of your investment portfolio evaporate in a few weeks. It’s quite another to watch it happen for real and have the wherewithal to stay the course. Bonds offer some consolation in such a scenario.

6. Can I take out a loan against my IRA?

No. While some 401k plans offer options for loans, you cannot take out a loan against the principal of your IRA. For Roth IRAs you can withdraw your contributions tax- and penalty-free at any time. Once you do so you will not be able to replace previous years’ contributions. For example, if you withdrew $50,000 of contributions from your Roth IRA you would only be able to replace up to the current annual limit of $5500.

7. How do I open an IRA? Where should I open one?

Opening an IRA is generally very simple, requiring your tax identification information, personal identity information, and your bank account information for the electronic transfer of your initial contribution. You should open an IRA with a company known for providing low expense ratio index funds such as Vanguard, Fidelity, or Charles Schwab.

8. When can I contribute to an IRA?

You have until April 15 (tax day) of the following year to make a contribution for a given tax year. For example, you have until April 15, 2014 to make an IRA contribution for tax year 2013.

9. My income is too high to contribute to a Roth IRA, therefore I also am ineligible for the deduction to a traditional IRA. What should I do?

The backdoor Roth IRA may be a good option for you. In this arrangement you contribute to a traditional IRA without claiming the deduction, then convert the balance to a Roth IRA soon afterwards. It is almost never a good idea to make a non-deductible contribution to a traditional IRA, as doing so would mean that your earnings would be taxed.

10. Is the backdoor Roth legal? It sounds sketchy.

There are no income limits on IRA conversions, so unless/until Congress changes the tax code the backdoor Roth is perfectly legal.

Cite: This article has been contributed by aBoglehead — http://www.bogleheads.org/